How might we give customers a completely personalized rewards experience?

Not everyone likes free things. Rewards are more impactful when they are relevant to the person receiving it. Prioritizing relevant or limited rewards makes the customer more likely to act and use accrue rewards.

My role

I created the UI, user experience flows, visual design elements, screen layouts and conducted user testing.

Goals

Take the rewards portal to the next level

Create a VIP experience driven by special offerings

Illustrate how data ecosystem can influence and elevate reward choices.

2. The planning phase

This experience was all about bringing the user value.

Customers want their rewards dollars to matter and give them something they want. This personalized approach changed the current rewards platform into an engaging customer adventure.

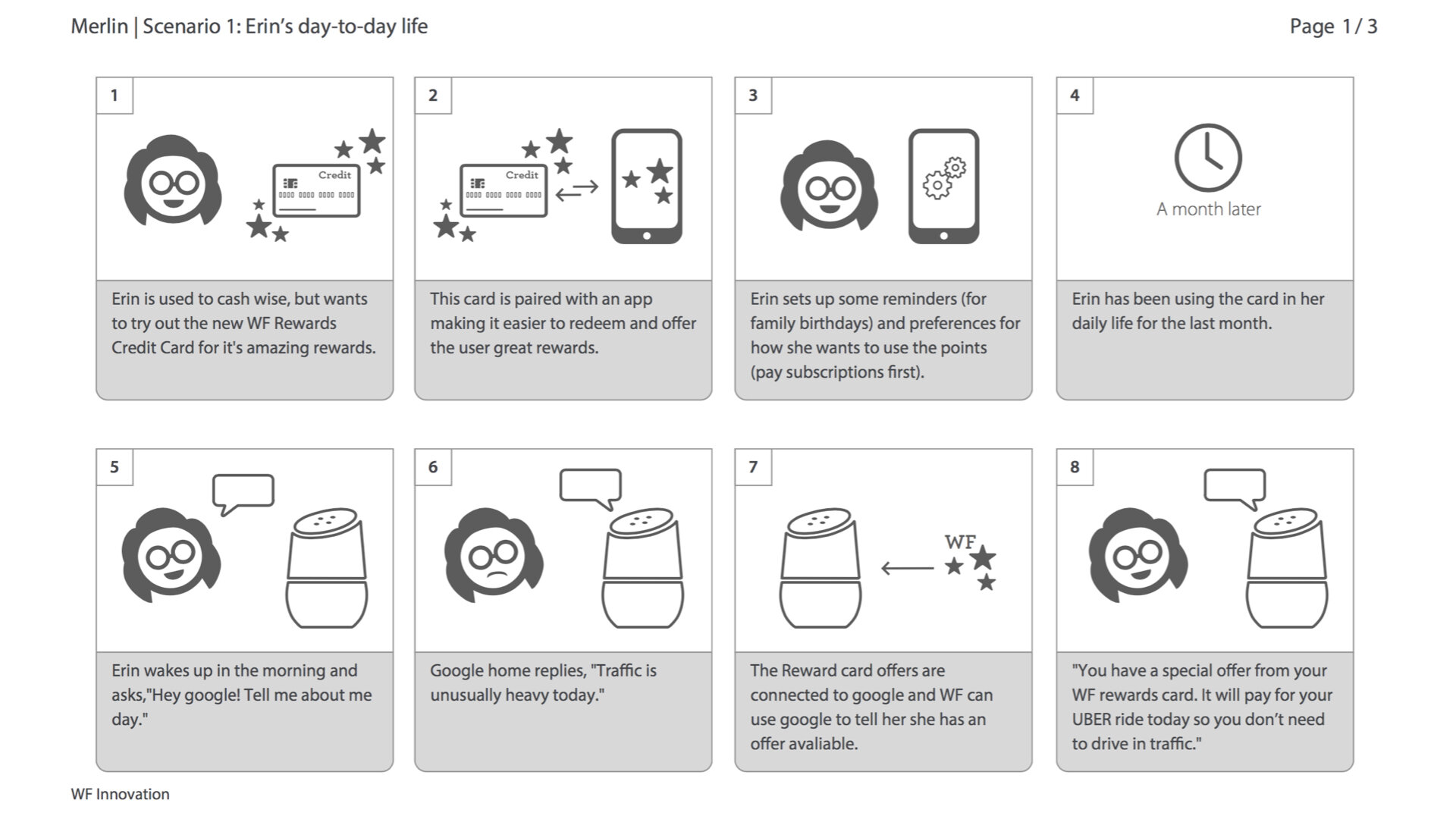

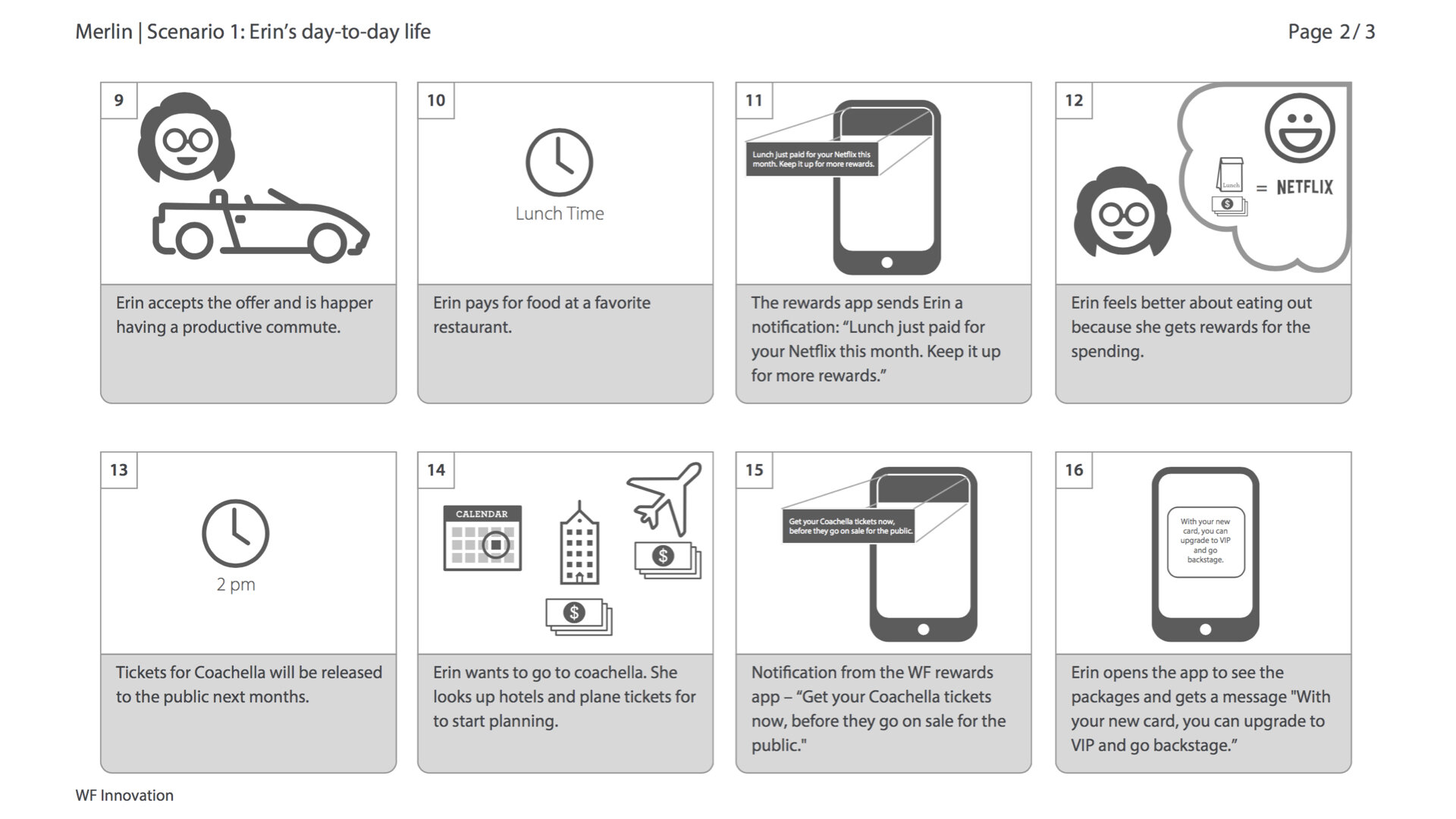

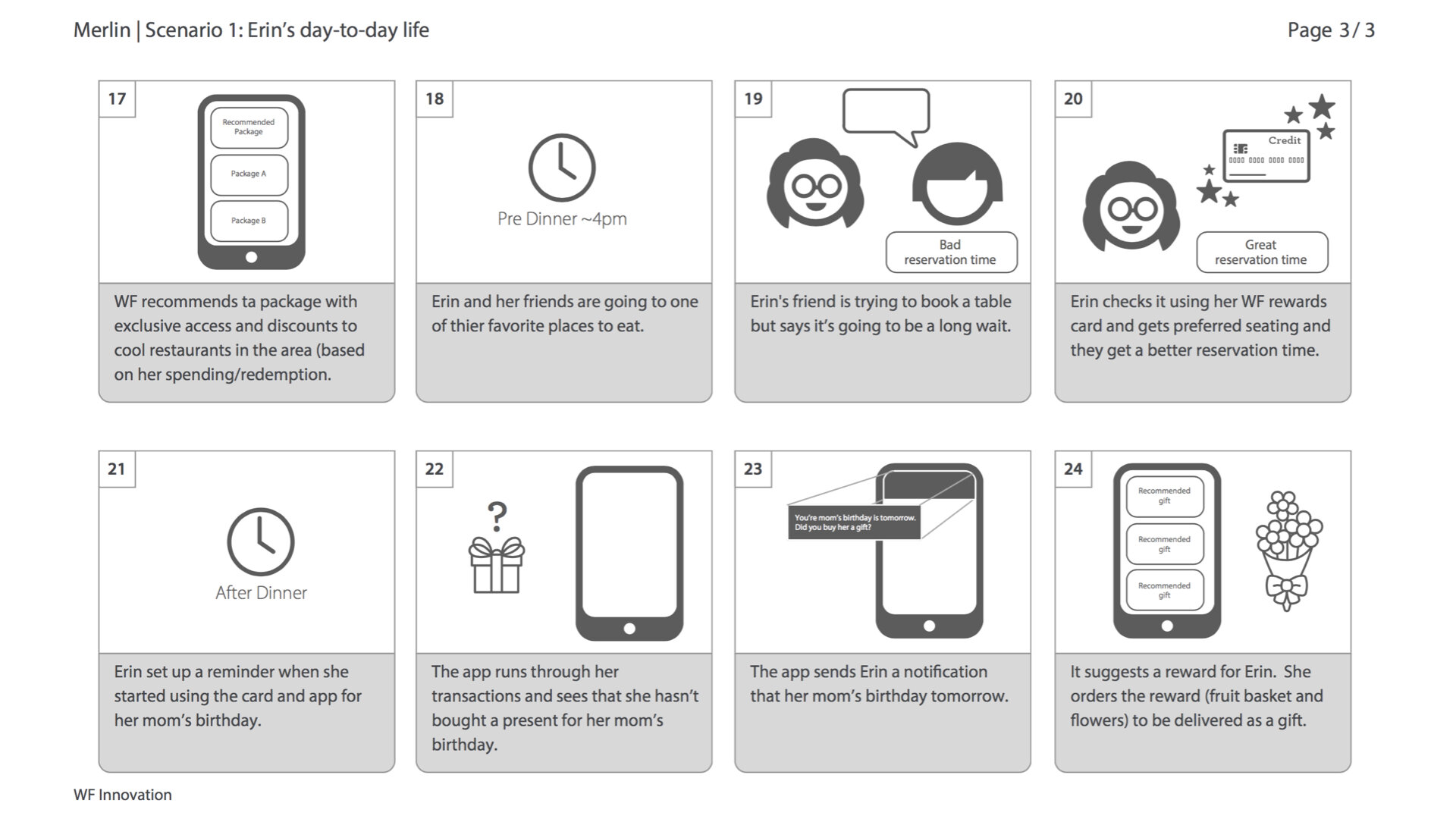

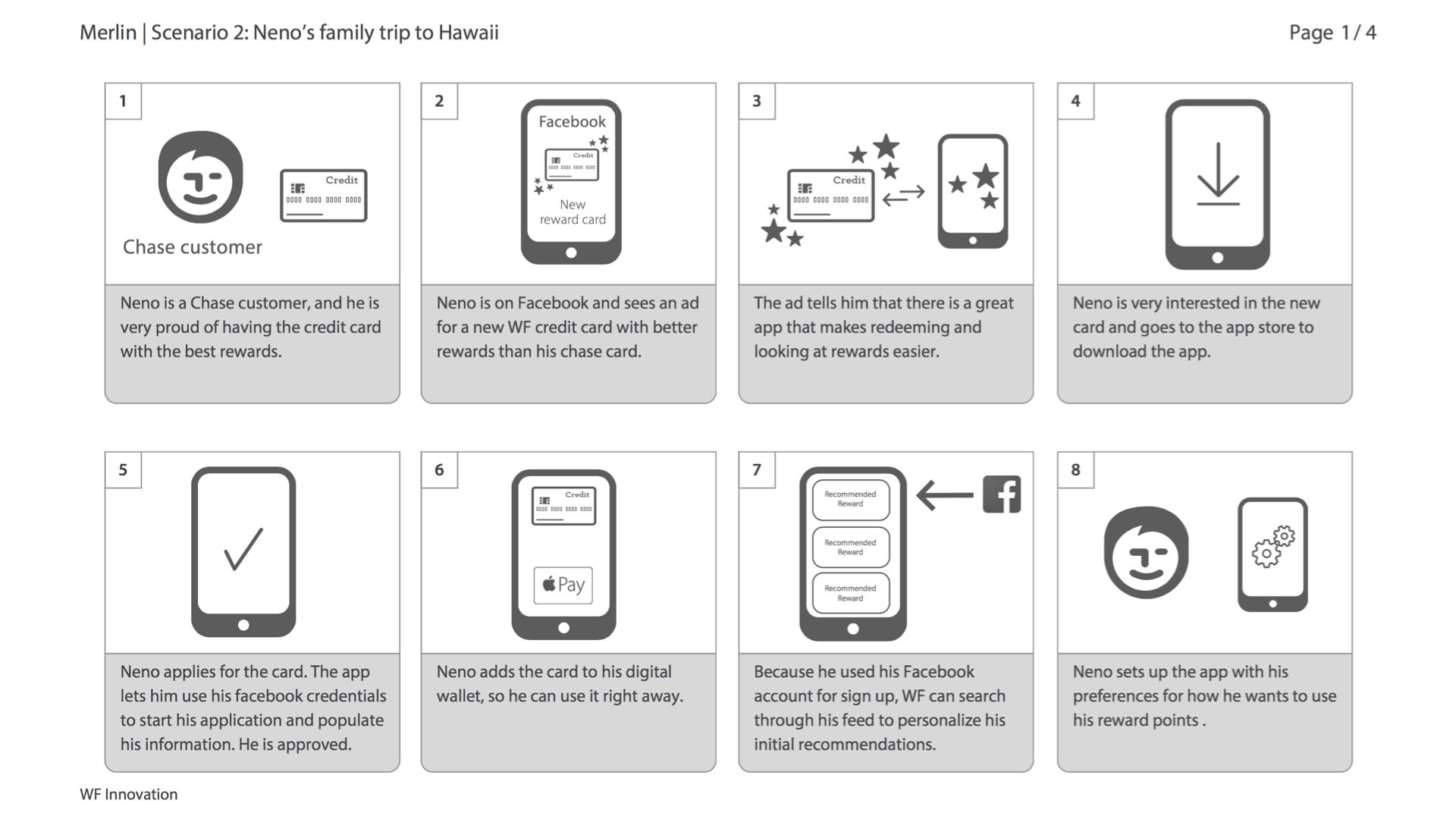

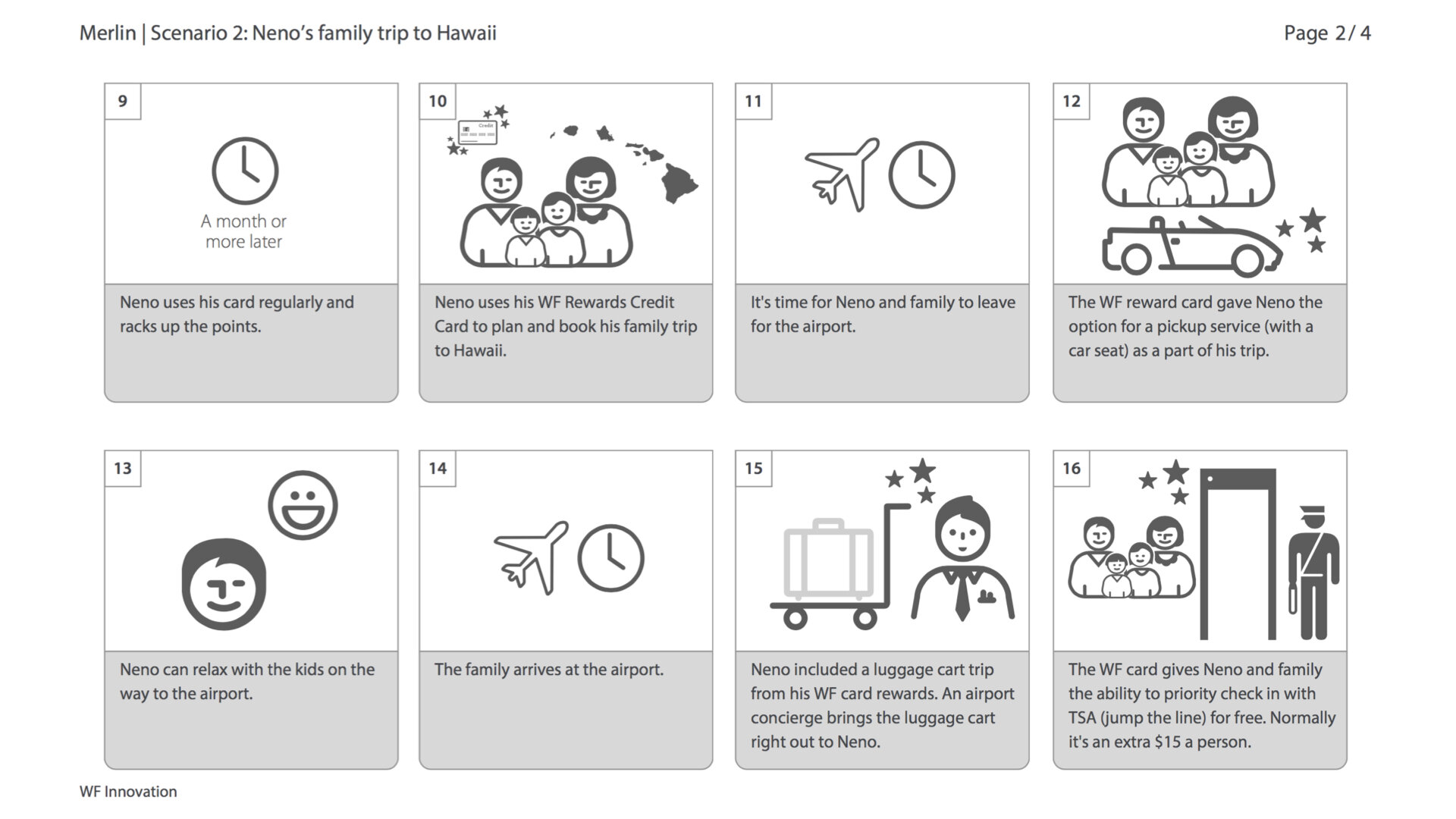

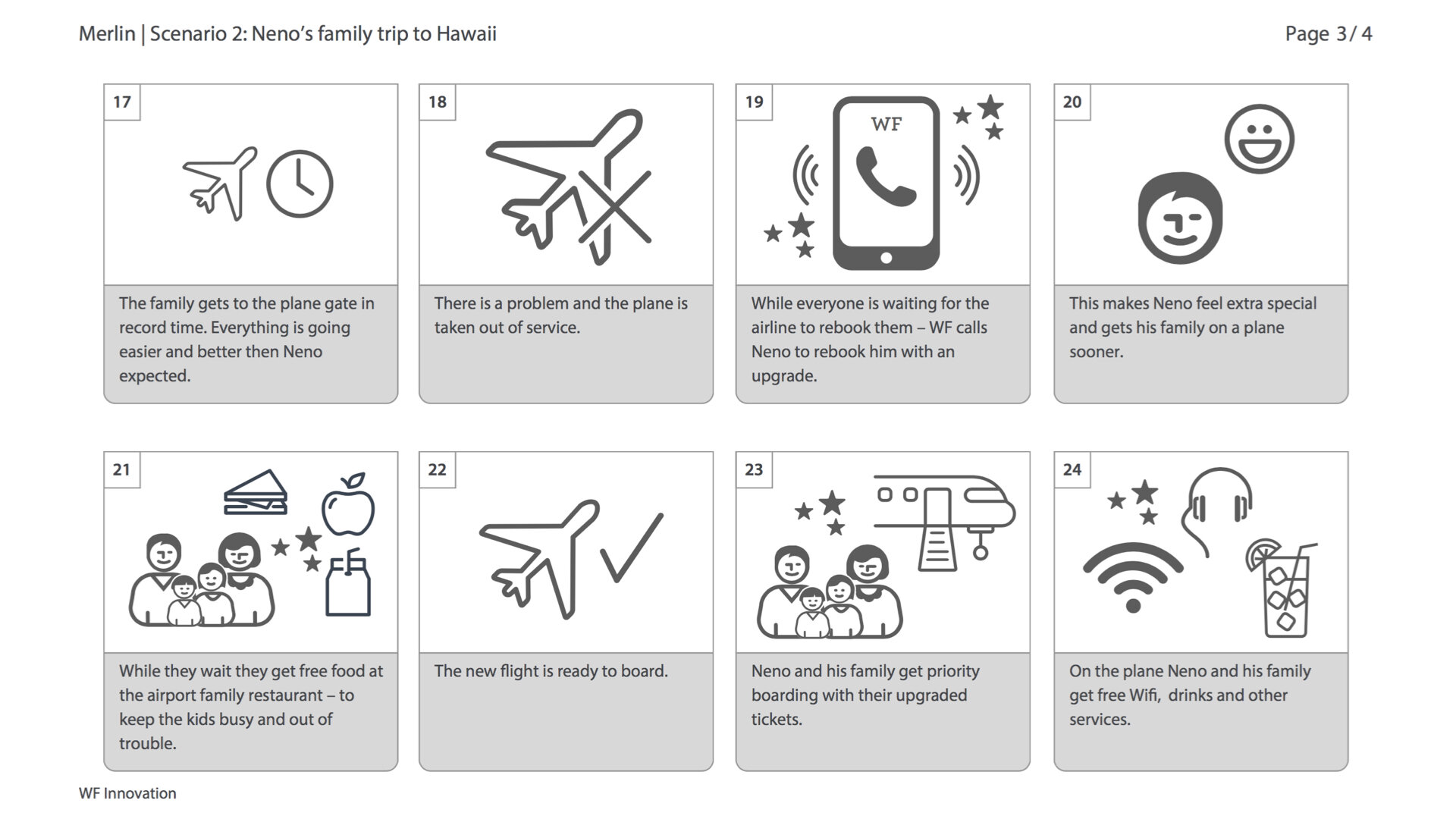

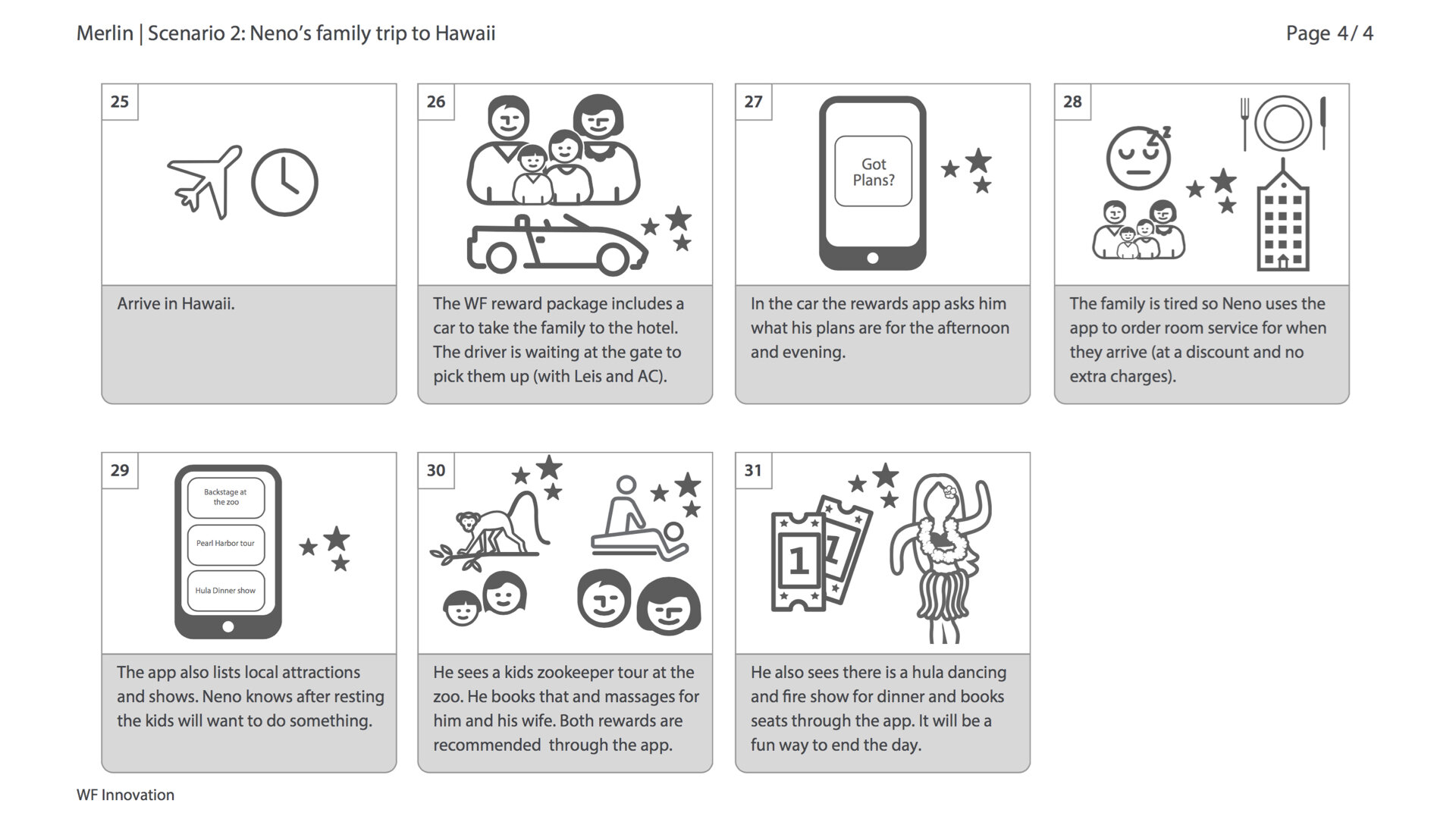

To help frame why the experience was taking such a transformational approach I created project personas and story board examples to help cement the project team and leadership about who the customer is.

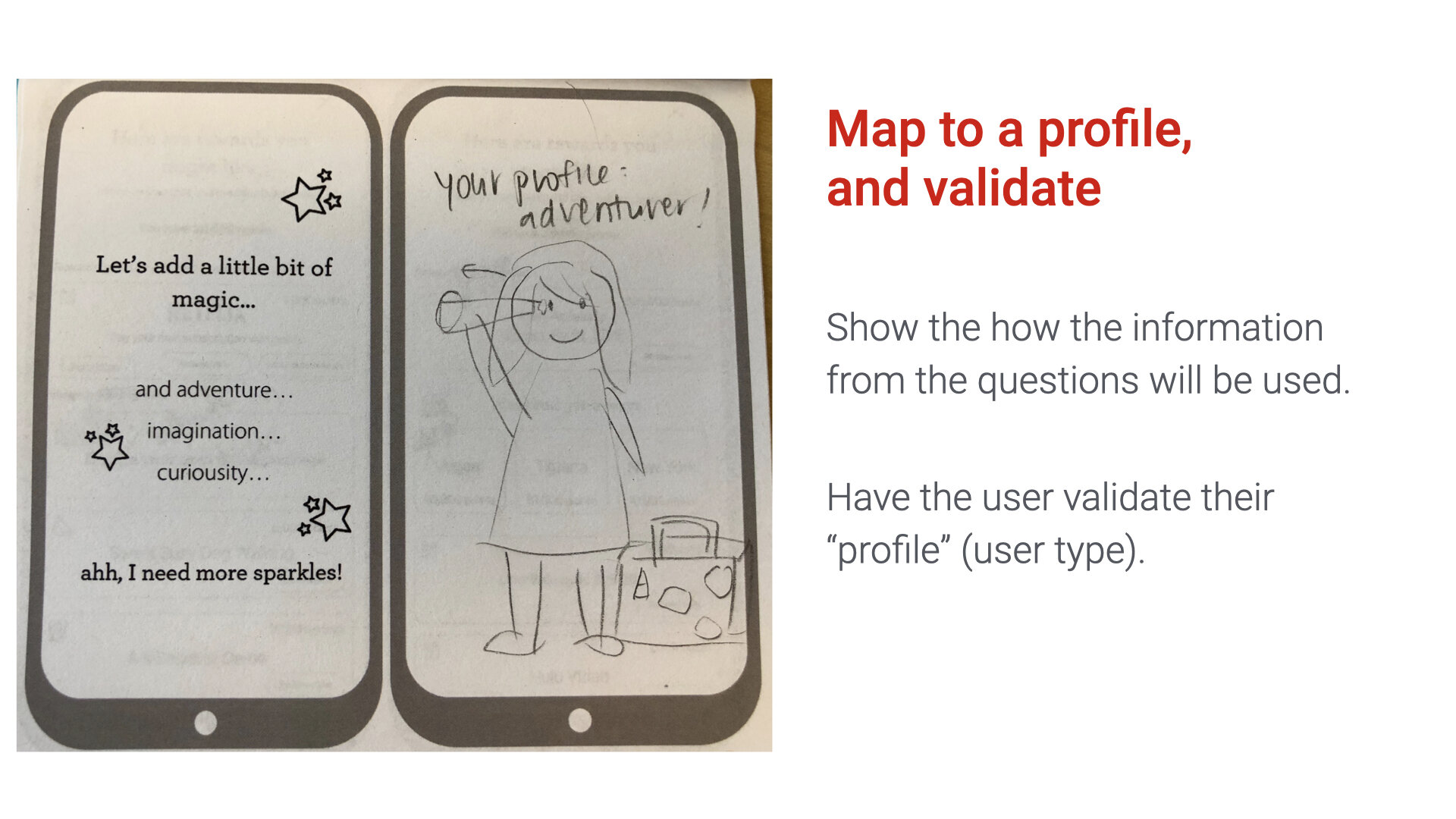

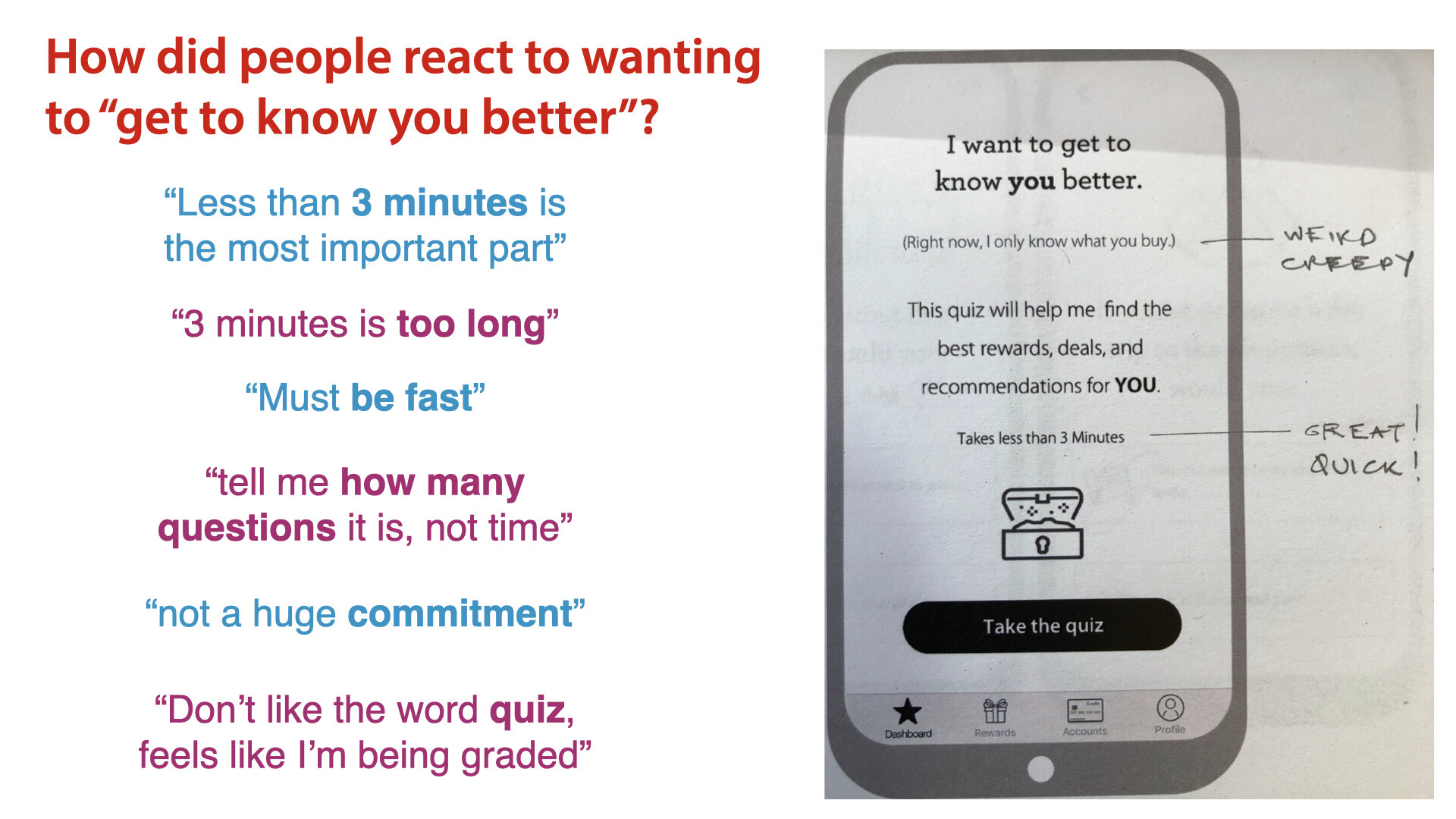

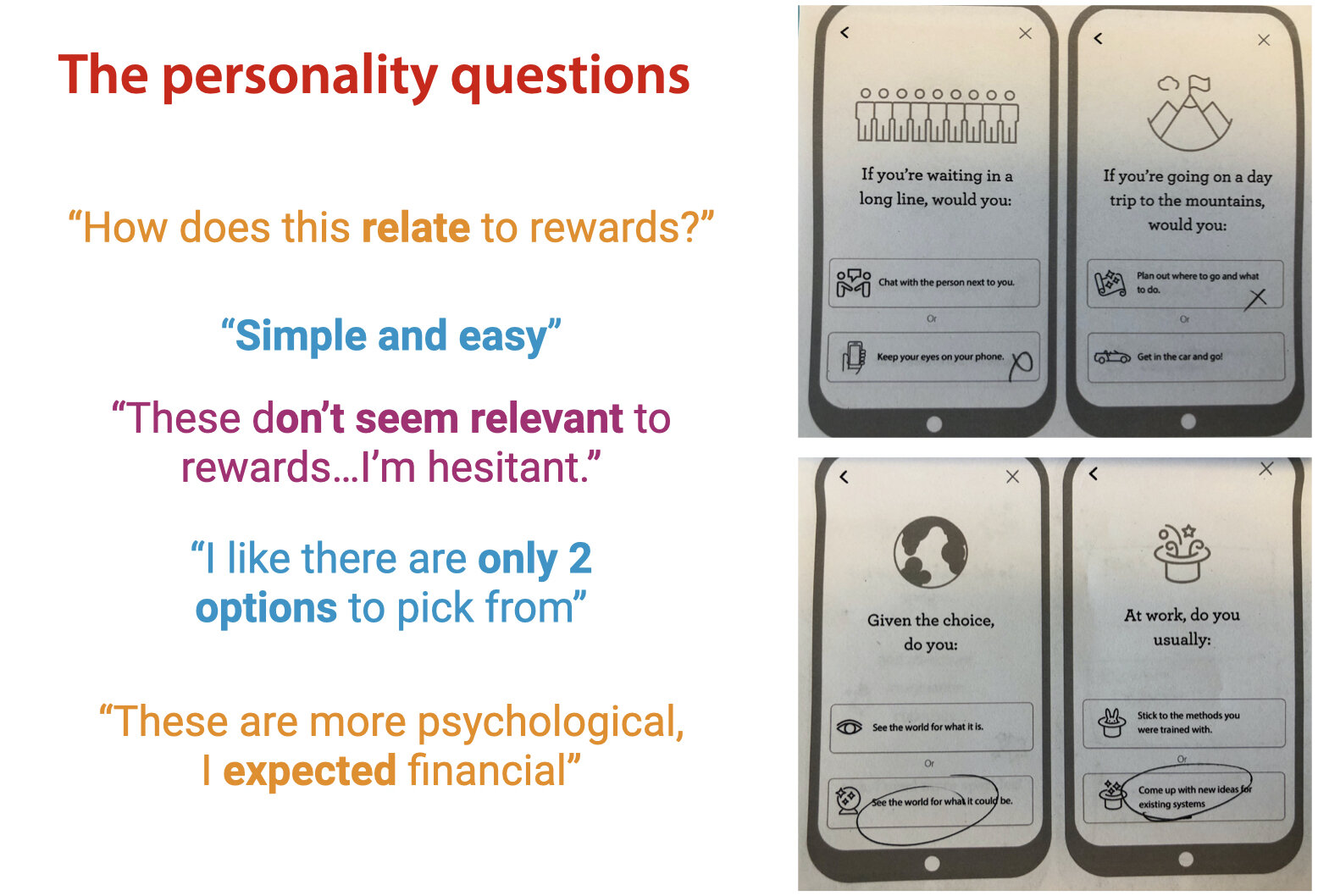

The business analyst and I did a variety of research on onboarding styles and found that people like doing social “quizzes”, like what “Hogwarts house are you in? Find out”. We agreed that a “personality test” type onboarding would be very different for a banking app, but would be very refreshing for our users. We looked into personalization AI and personality types designing out a the “get to know you better” experience.

3. The design phase

Using the personify type, customer transactions, historic data and profile, the system hand picks rewards based on how relative it is to the customer.

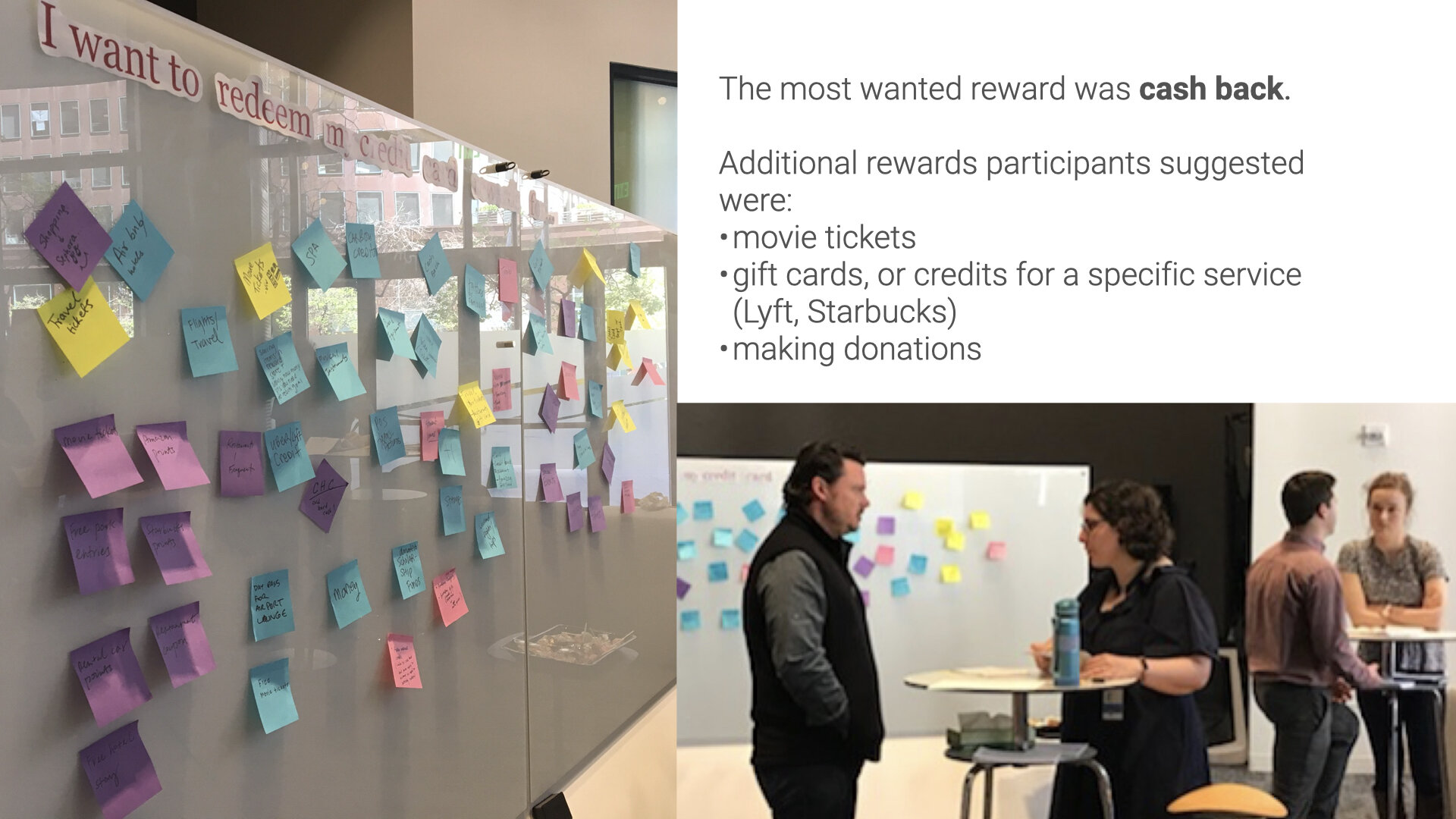

Historic transactions feed into options like gift cards or credits to other services. Rewards to places users would likely shop was both desirable and a differentiator for other rewards software available.

Research

I partnered with the research team to do a Pop-up lab allowing us to talk to 35 team members about the experience for direct feedback. Everyone agreed this was a very different type of rewards offering that they would be interested in using - if the way to accrue rewards was competitive and made sense to them.

Closing

This experience is being discussed by multiple line of business leaders on execution and future planning. The current rewards experience is provided by a vender. This means either a new vender will need to be brought in for this product, or the bank will need to build out the technology internally. This work was able to start conversations, and prove out what a future experience should look like as the company makes updates to both its offerings and it’s brand. I hope it can work its way into roadmaps for implementation sometime in the future.